TVS Automotive Europe is hoping to boost sales of Indian auto parts to companies in the United Kingdom and Europe. The company is using India’s low-cost production facilities and highly qualified labor force as a selling point.

TVS Automotive forms part of the US$2.6-billion Indian TVS Group, according to R. Dinesh, director, TVS Automotive Europe.

The company’s primary business is to be the nodal agency for buyers in the UK and Europe, who want to source automotive parts from a wide range of Indian manufacturers. The company also plans to expand its operations to source parts from other low cost countries in Asia. According to the company, the benefit of sourcing auto parts in India could result in a savings of up to 25%.

TVS Automotive Europe believes in packaging the sourcing activities from low cost countries with value added services such as supplier audits, inspection of samples and PPAP, providing warehousing and JIT deliveries. The Company believes that this will enable UK / Europe customers to get over the supply chain related inefficiencies. In fact, they have successfully implemented Vendor Managed Inventory Projects for reputed Tier 1 companies in UK and Europe, he says.

Currently, India exports US $800 million worth of auto parts to the US, Europe and Asia. This is expected to touch US$25-billion over the next two decades. Some of the companies that buy Indian automotive parts include Bosch, Caterpillar, DaimlerChrysler, Delphi, Denso, Ford, GM, Hyundai, Visteon and Volvo. However, India’s share of the US$1-trillion auto parts market is miniscule. TVS hopes to change this.

The UK-based TVS Automotive Europe is a subsidiary of TVS Logistics Services which offers supply chain management solutions to automotive companies.

TVS has increased its presence in UK by acquiring majority stake in a company in Daventry, UK, owned by the Jarrett’s family. The new company which has been renamed TVS CJ Components offer end-to-end supply chain solutions to its customers. TVS CJ Components already has an established customer base including Cummins, CNH and JCB. While increasing its business with these clients, TVS CJ Components is also adding on new clients. The new company has a large supplier base in India and also has supplier relationships with companies from Turkey and other European countries.

Customers of TVS Automotive Europe will also benefit from this physical presence. In addition to the acquisition, TVS has finalized a number of tie ups across Europe. This includes a JV in Spain with the Transcoma Group and a recent alliance in Germany with Wincanton. “With this co-operation agreement TVS is now ready to provide a seamless supply chain from Asia into every country in Europe and vice versaâ€, Dinesh told reporters at the time the alliance was finalized.

The reverse logic is also equally true. TVS Automotive Europe is able to provide logistics and marketing support to Indian firms. “The Tier 1 and Tier 2 suppliers in India have grown their businesses globally and we need to support them,†says Dinesh.

Apart from Europe, the company also has a presence in the Far East in countries such as Thailand. It is also expanding in China and the US. TVS has a majority stake in all its international alliances.

Automotive Industries (AI): How successful has TVS Automotive Europe been as an agent to bring together European companies with Indian automotive component manufacturers?

Dinesh: Initially TVS Automotive Europe had to sell India as a sourcing destination. Now it is not so. The organization is now working closely with Tier 1 and Tier 2 companies in European countries. Being part of the largest automotive group in India, the company has an in-depth knowledge of the automotive component manufacturers. Secondly, the TVS brand is well accepted by European companies because of its excellent manufacturing capabilities. But growth is expected to be huge in the next few years both with existing and new clients.

AI: What plans does TVS Automotive Europe have in Asia? You are reportedly looking at expanding in China and the US?

Dinesh: As a Group, TVS is obviously looking at strengthening its presence in Asia. TVS Automotive Europe will leverage a TVS sourcing office in China in 2006 to provide a choice to its European customers between the best of both India and China in terms of price and quality.

AI: How has your company had to evolve to do business in Europe, and how will it have to change to expand in the US and Europe?

Dinesh: Evolution has been to firstly sell India as a destination and then to offering a seamless and total solution. Nevertheless, TVS Automotive Europe started with sourcing as its key strength. It has now added logistics and supply chain solutions to its portfolio as part of the services to be offered to the clients. There is a local office in Europe / UK, physical infrastructure with warehousing and transportation as well as quality and engineering support available in India to provide best possible sourcing options. We see our participation in TVS CJ Components as being one of the ways forward to provide the best quality seamless supply chain.

In future, we see a lot more supply chain solutions by either acting as the outsourced buying arm of the manufacturers in Europe / UK or as the outsourced marketing arm of the Indian suppliers.

AI: How do you see India emerging as a global source for automotive parts? And what are some of the challenges that face India to become a global hub for auto parts?

Dinesh: The challenges in the future would be the inevitable comparison between India and China but our belief is that it is not “India OR China†but it is going to be “India AND Chinaâ€. Secondly, capacity creation for the huge outsourcing volumes in India could be a short term challenge. Lastly, the total supply chain solution availability and competitiveness could be a deterrent for quick growth. However, TVS will try its best to offer its support on the last requirement to the maximum extent.

AI: Why should a customer source from TVS Automotive Europe when there are a number of players offering a similar benefit or a customer can open a global sourcing office?

Dinesh: In the Internet age, the general belief is that intermediaries would not be required. However, we find that the sourcing of components, whether of low or high technology, is a complex issue. With the time pressure, even very large companies do not have adequate focus on actually developing a supplier. Secondly, high investments need to be made to develop a buying or selling office by individual companies.

TVS Automotive Europe actually plays this handling role. By becoming a specialist in this field, TVS Automotive Europe will act as an outsourcing arm for both buyers and sellers. TVS Automotive Europe also provides combined supply chain solution as a single package including billing in local currency. Therefore our study shows that it will be both cost and time effective for customers to go through a company like TVS Automotive Europe rather than form their own companies directly.

Similarly – unlike normal agents – TVS Automotive Europe is not restricted to merely covering the information gap but offers the complete solution. This we believe will help both buyers and sellers grow their business together in the most cost-effective way.

Equally important is TVS’s presence in India and other low cost countries. This enables the company to reach up to the premises of the manufacturer in India with its regional hubs operating for the automotive logistics domain. Incidentally, TVS is the market leader as far as automotive logistics domain in India is concerned. The Group also brings on the table a wealth of experience in shipping automotive components which are rust prone and need special handling. Buyers in Europe can leverage the company’s shipment volumes and frequency from India to Europe for consolidation and competitive costs.

More Stories

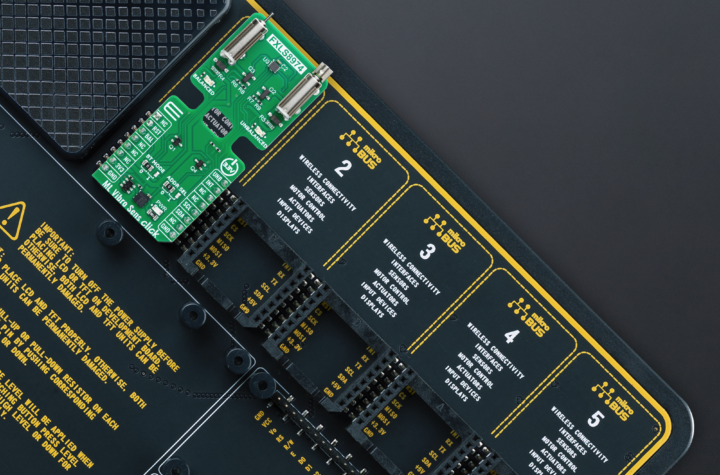

Mosaic Click board from MIKROE delivers global coverage multi-band and multi-constellation tracking ability

Current transducer from Danisense selected for DC charging station testing device demonstrator at TU Graz

New Click board from MIKROE helps develop and train ML models for vibration analysis