In this issue, Automotive Industries explores changes in supply chain management for the parts industry. Michael Stewart spoke to Bengt-Eric Sjolinder Global Industry Director Automotive with DHL Global Customer Solutions.

Automotive Industries (AI): What are the changes in the business environment for parts as you see it?

Sjolinder: Four major evolutions in the business environment for parts have become apparent.

Firstly, there has been the development of a parallel spare parts market. OEM’s are facing increased competition from their own suppliers – OEM’s are increasingly outsourcing the components used in their cars. Inevitably, this means increasing amounts of ‘genuine’ spare parts are also produced by third parties. The OEM’s do not have the same – if any – control over these suppliers as they do over in-house suppliers.

Secondly, there has been an improvement in the quality of new vehicles. In the last 15-20 years, the maintenance intervals for ‘the average new car’ in mature markets have increased three to five times (from roughly every 7 500 – 10 000 kilometres in the eighties to every 30 000 – 50 000 kilometres today). This means fewer visits to the dealers and hence less frequent demand for spare parts.

The third change in the business environment for parts has been the increased complexity of cars. Cars contain increasing amounts of components and technology (for example active safety systems, GPS, electronic engine management), which means a higher number of spare parts need to be available for repair and maintenance.

Fourthly, there have been regulatory changes in the European Union. The EU Block Exemption regulation essentially means the OEM’s loose the monopoly on spare parts with their dealers. Dealers can source parts from any supplier they see fit.

AI: What challenges does this present?

Sjolinder: The challenges relate to the European spare parts market in three areas.

OEM’s

With regard to OEM’s, one of the challenges is to see competition arise in a market that has been monopolized for decades. Another challenge is the loose grip on the major distribution channel in the market.

Due to the monopoly situation, margins on spare parts are high. With margins on new vehicles being under severe competitive pressure, the after sales revenue is vital for the financial health of all of the major OEM’s.

Whilst they can differentiate themselves through the ‘genuine parts’ stamp, the OEM cannot justify a large price gap between his ‘genuine parts’ and the prices of alternative suppliers for two reasons. Firstly, some of the largest alternative suppliers have a strong brand name themselves, either reducing or completely eliminating consumer and dealer quality concerns. Secondly, the consumer mostly leaves the choice of the spare parts up to his/her dealer, who is in a much better position to judge the real value proposition of the spare parts.

Parts warehouse

There are two main challenges facing us in the parts warehouse. One of them is that the warehouse needs to hold a higher number of inventory references (reflecting the increased number of components in a car). The other is the less frequent need for spare parts due to improved car quality. All other things staying the same, this leads to a decreasing inventory turn-around ratio. The impact of this evolution is partly direct (need for more warehouse space). However, the indirect impact (more complex inventory management) is at the same time harder to manage and potentially more costly than the direct impact.

Dealer

From a logistics perspective, the key challenge for a dealer wishing to purchase spare parts from parallel suppliers is in the administrative and planning burden: in the traditional after sales concept, the dealer holds a small stock of fast moving parts and gets overnight deliveries of any other parts he or she needs.

Essentially, the dealer entirely manages his own inbound supply chain, which requires a resource investment from his side. When using multiple suppliers for the spare parts, this management task increases. For every repair or maintenance job, the dealer needs to find out which supplier to use, whether the supplier is able to source the parts or not and how much time it takes for the part to be delivered. The management workload increases exponentially with the number of suppliers used.

The major disadvantage of the classic after sales logistics set up for both the dealer and the customer is that it regularly occurs that a consumer needs to wait one or more days for his or her car to be repaired for the reason that unplanned parts take at least one day to be delivered to the dealer. Bring multiple suppliers and an increased number of less frequently used parts into that picture and you can expect the average repair time to increase simply because the spare parts are not available when they are needed.

AI: What is DHL doing to provide solutions for these challenges?

Sjolinder: DHL has introduced the Local Distribution Centre (LDC) concept to increase the spare parts availability at dealer level and offer a tangible competitive advantage to the OEM. Through the LDC concept, the dealer receives two to three deliveries per day (one during the night, one in the morning and one in the afternoon). If ordered in the morning, unplanned parts can be delivered to the dealer on the same day in the afternoon. The consumer therefore is likely to have his or her car repaired on the same day.

This solution also cuts dealer administration and planning time as well as inventory. With a near 100% same day spare parts availability, the dealer stock can be reduced by approximately 75%. In addition, the dealer does not need to plan his work in advance. On one hand this benefit creates commercial opportunities (maintenance without appointment) and on the other hand it eases the planning process related to the pre-ordering of parts based on the scheduled jobs.

AI: Please describe the Volvo Car Corporation project.

Sjolinder: In close co-operation with Volvo Car Corporation we have developed a 3-layered logistics set up.

The first layer is the Central Distribution Centre (CDC). The CDC holds an inventory of every individual spare part and feeds the Mega-LDC’s through scheduled full- and less than truck load feeders. In comparison to the classic automotive after sales warehouses, the CDC holds less inventory thanks to the buffer inventory in the LDC’s. Furthermore, the management is less complex and the transportation cost is lower (large, non time-critical consignments to a limited number of mega-LDC’s vs. small time-critical consignments to individual dealers).

The Mega-LDC’s – the second layer – are located across the country. The exact location is determined by the dealer locations. Like the CDC, a mega-LDC holds the full range of spare parts, however there is only a very limited inventory of each item as the inventory is replenished from the CDC several times per week. The mega-LDC performs 2 roles:

First, it organizes the delivery of spare parts for pre-planned work to the dealers before the start of the working day (in-night deliveries). Thanks to the proximity to the dealers, the deliveries of several individual dealers can be consolidated which is very cost-effective.

Secondly, the mega-LDC replenishes a limited number of micro-LDC’s on a same day basis.

This brings us to the micro-LDC – the third layer. The micro LDC’s serve up to 15 dealers and are located within a maximum of 2 hours driving distance of them. The inventory in a micro LDC is very limited both in terms of volumes as well as in terms of individual items. A micro-LDC organizes 1-2 on-request deliveries to dealers that need spare parts they had not pre-ordered. Thanks to the proximity to the dealers, orders can be handled and delivered the same morning or afternoon they are ordered. Like the mega-LDC, one single delivery truck or van will serve several dealers on his route which pushes down the transportation cost. The scheduled same-day feeds from the mega-LDC’s to the micro-LDC’s guarantee a near 100% same day spare parts availability.

If you add it all up, there are only winners: Dealers save cost and have a commercial benefit over their competitors. Volvo drivers get an unrivaled service for an affordable price. And Volvo Car Corporation has dealers and drivers who don’t have any reason to take there business elsewhere.

More Stories

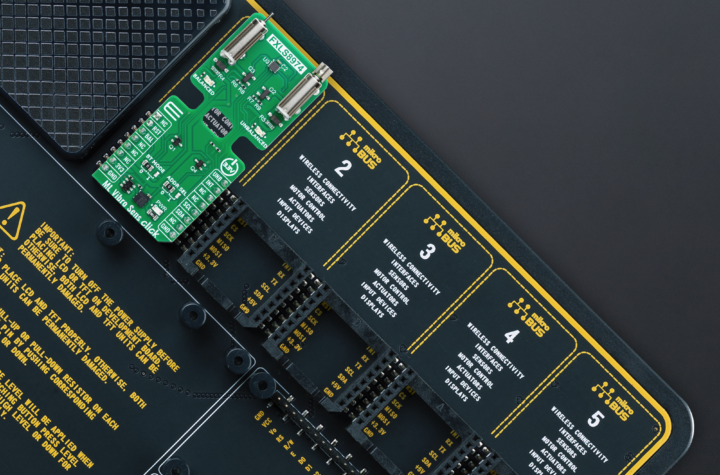

Mosaic Click board from MIKROE delivers global coverage multi-band and multi-constellation tracking ability

Current transducer from Danisense selected for DC charging station testing device demonstrator at TU Graz

New Click board from MIKROE helps develop and train ML models for vibration analysis