For most automotive suppliers, the concept of a “hydrogen economy” populated by fuel cell vehicles (FCVs) seems like science fiction. And who can disagree?

For most automotive suppliers, the concept of a “hydrogen economy” populated by fuel cell vehicles (FCVs) seems like science fiction. And who can disagree?

Investing in an unproven technology that’s at least a decade away from having even a basic market, let alone an infrastructure, appears both risky and foolish.

Indeed, there will be no pot of gold in the near term, nor right over the horizon. It’s unlikely the industry will see modest FCV volumes in North America until the 2020 timeframe. Being a supply pioneer in 2003 means betting on a paradigm shift that’s five vehicle design cycles away in the future. Certainly it’s a gamble, even for those companies convinced the future will be hydrogen fueled. But amidst the uncertainty, one thing’s sure: FCVs will get nowhere without the supply chain’s direct involvement.

According to Byron McCormick, executive director, GM fuel cell activities, the list of vendors supporting GM’s program was already growing before President Bush’s 2003 State of the Union address. That “galvanizing” speech “immediately brought more potential suppliers to us,” he notes.

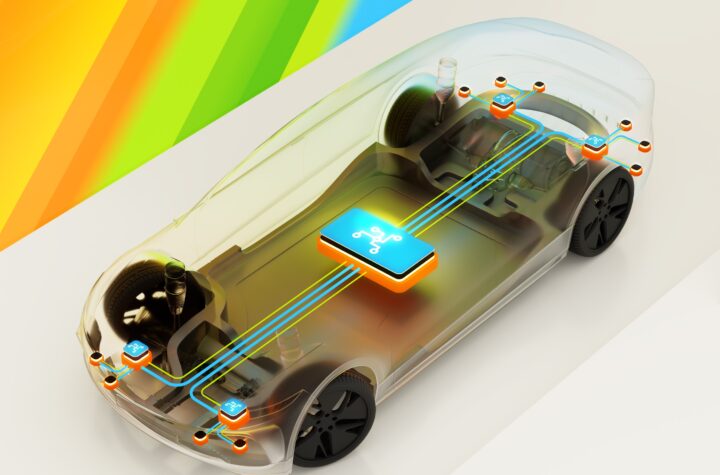

Like other automakers who have committed to fuel cell development, GM has a laundry list of technology issues for which it needs supplier help. “We need bipolar plates that can be made inexpensively,” says McCormick. “We need seals. We need compressors and bearings that can work in a hydrogen environment.” And so on.

In some cases GM is actually paying suppliers to develop components. It has chosen others to work with so they can test their wares in realistic environments. “Driving cost down and performance up is only going to happen partially in the lab,” McCormick explains. In every case, vendors must deliver to quality standards that would make Toyota’s seem like British-Leyland’s.

McCormick and his team recognize supplier trepidations about entering the field, and offer the following. “Our strategy is to do fuel cell development in a way that allows suppliers to make a business case at 1,000 units/year, 10,000 units/year and 100,000 units/year — our incremental steps towards volume production,” he explains. The first stage will supply real-world test fleets and is strictly hand-assembled fuel cell “engines.”

Some assembly automation marks the 10,000-unit stage. At 100,000 units/year, cell-stack assembly will be fully automated. “The biggest mistake suppliers can make is not joining the fuel cell trend at the 1K and 10K levels,” states McCormick. “This is a key business decision — not to lock themselves out of the future.”

He cites the recent book, The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail (Harvard Business School Press). One of author Clay Christenson’s key points is that many aggressive, forward-looking companies often delay introduction of new technologies due to fear of impacting sales of existing products. They get clobbered every time a competitor springs a disruptive technology into the market. The book details the computer industry’s past 20 years of this mindset — the reason why many former giants of that segment have disappeared. It’s the “innovator’s dilemma” — being held hostage by your current customers. But new technologies can also create new markets and customers, avoiding the feared cannibalization.

In GM’s view, suppliers who take a risk on disruptive technologies — with or without the promise of contracts and/or payback — should be rewarded. Thus the company this year began a formal “Supplier of the Year” award for top fuel cell program vendors. Those suppliers must keep pace with a highly dynamic technology, one which may make some current necessities (such as the humidifyer and DC-to-DC converter) obsolete.

Soon the chemical industry will have “tailored polymers” aimed right at fuel cell vehicle applications.

The benefits of overcoming the innovator’s dilemma — and the penalty for succumbing to it — may already be evident to GM’s purchasing staff. Roughly half of the suppliers working with GM on fuel cell vehicle technologies are not traditional automotive OEMs. To them there’s no question about where to place bets on the future. For the other half, it’s not science fiction either.

Lindsay Brooke is Senior Manager of Market Assessment, CSM Worldwide Inc.

LindsayBrooke@csmauto.com

www.CSMAuto.com

More Stories

What You Need to Know Before Customizing Your VW Transporter

The Difference Between Coin and Token

From Gasoline Powered Cars To Electric Vehicles | Electric Moped Bike A Best Alternative