In Volume 192 Issue 3 of Automotive Industries we look at two instances where American states have steered their automotive industries back onto the road to growth and job creation. Reindustrialisation creates many opportunities – and threats – for the whole automotive value chain, including component manufacturers and logistics companies. Companies which have switched their focus and energies to India (where vehicle sales have fallen for the second year in a row) and China (where domestic demand remains strong but exports are dipping) may lose out on growth in their traditional home markets.

We report on South Carolina, which has made a U-turn away from total closure of the industry to attracting over US$5 billion in capital investment from the world’s leading OEMs and Tier 1 suppliers. And Missouri, which is powering ahead thanks to a partnership between the state, labor and industry leaders. Across the Atlantic, the British auto industry is revving up. Speaking in April 2013 at the 2013 Society of Automotive Engineers’ World Congress in Detroit, UK Minister of State for Business and Energy Michael Fallon said “automotive in Britain is now a success story. We’re exporting more by value than we’re importing for the first time in 30 years.” The UK is also building more cars – in assembly plants which, incidentally, are all foreign-owned – than it did in British Leyland’s heyday 30 years ago. On the Continent we have emerging auto hubs in the likes of Poland, Hungary, Macedonia, Serbia, Turkey, the Czech Republic, and Slovakia. Russia’s auto industry is on track to pass Germany’s production by 2020, according to the Boston Consulting Group. Motor manufacturers are also returning to Africa.

Recently, Nissan and West African conglomerate the Stallion Group announced plans to increase vehicle assembly in Nigeria. Stallion currently produces commercial vehicles in Nigeria, and capacity will be increased to 45,000 cars, light duty trucks, pickups and vans a year. Renault may also make use of the facility. In Kenya, a start-up auto firm that is offering US$6,000 cars designed for African roads has started assembling at the Kenya Vehicle Manufacturers (KVM) based in the central Thika province. Currently, over 35% of the new vehicle’s cost is sourced domestically and Mobius Motors is looking to grow local content beyond 40%. Another win for the Kenyan auto industry is that Toyota has opened a US$4.9 million truck and bus assembly plant and showroom in Kenya.

Chinese assemblers are also showing interest in Kenya. Chery Automobile and Beiqi Foton Motors are both reported to planning assembly plants. Kenya, Zambia and Zimbabwe are among the African states which saw massive disinvestment following nationalisation. Assemblers are dusting off their old facilities as South Africa, currently the hub of motor assembly in Africa, is facing a crisis of confidence following protracted strikes and uncertainty over government policy. To the east, the Australian government has realised the contribution made by the auto industry. The Australian, Victorian and South Australian governments’ Automotive New Markets Programme (ANMP), currently in its second round, is designed to help companies capture new business opportunities in domestic and overseas markets, according to the government. A common theme when one looks at the auto industry is government intervention – for good or bad.

Support through incentives, tariff protection or other means (whether they adhere to the letter and the spirit of the World Trade Organisation agreements or not) drives the success of the auto industry in the real world where the playing fields are not equal. There are compelling reasons for government support – not the least being job creation. Even in Europe, where the industry is seen as “mature,” the auto industry created the most jobs through foreign direct investment in 2012, according to the Ernst & Young 2013 European Attractiveness Survey. If managed correctly, the auto industry also serves as a pool of manufacturing excellence and technical innovation. It can be argued that countries in the European Union together with the US are world leaders in accelerometer technology because of R&D by the automotive sector. There are many other examples. In a global auto industry where it is often more cost-effective to import than assemble locally, government and labor hold the key to success

More Stories

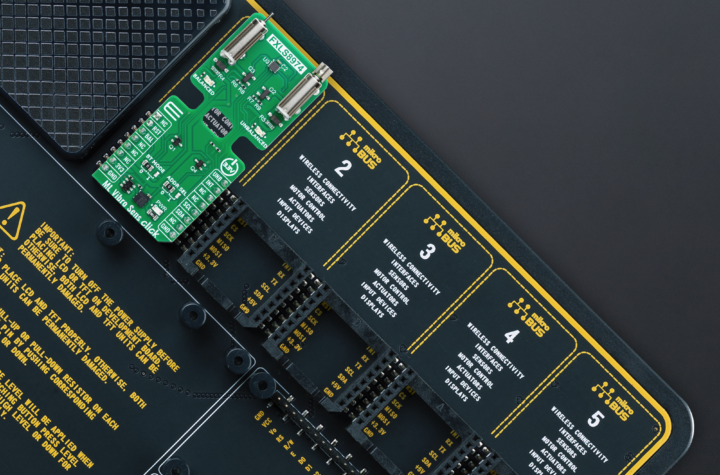

Mosaic Click board from MIKROE delivers global coverage multi-band and multi-constellation tracking ability

Current transducer from Danisense selected for DC charging station testing device demonstrator at TU Graz

New Click board from MIKROE helps develop and train ML models for vibration analysis