The Plastics Industry Association (PLASTICS) announced shipments of primary plastics machinery (injection molding and extrusion) in North America decreased for the second consecutive quarter according to the statistics compiled and reported by PLASTICS’ Committee on Equipment Statistics (CES).

The preliminary estimate of shipment value from reporting companies totaled $320.9 million in Second Quarter 2021. It decreased by 4.2% following the 11.1% decrease in First Quarter 2021. Compared to Second Quarter 2020, however, plastics machinery shipments rose by 21.2%. The value of shipments of single-screw extruders increased significantly by 33.1% from the First Quarter 2021, but twin-screw extruders and injection molding shipments fell by 24.9% and 4.9%, respectively. Compared to Second Quarter 2020, shipments of injection molding, single- and twin-screw extruders were 19.5%, 37.8%. and 32.3% higher, respectively.

“While new orders of plastics equipment have been increasing, ongoing supply chain issues–-shortage of parts and components––are causing longer order-to-delivery timelines. This explains the decrease in shipments in the second quarter. For the third consecutive quarter, plastics equipment shipments were higher from a year earlier. This means that the underlying trend in plastics equipment demand remains upward sloping – still in sync with the robust economic recovery,” said Perc Pineda, PhD, Chief Economist of PLASTICS.

Market Sentiment

PLASTIC’s CES also conducts a quarterly survey of plastics machinery suppliers that asks about present market conditions and expectations for the future. In the Second Quarter 2021 survey, 92.7% of respondents expect market conditions to either improve or hold steady in the coming quarter – marginally lower than the 93.5% of respondents who expressed the same view in First Quarter 2021’s survey. As for the next 12 months, 78.7% expect market conditions to be steady-to-better. This is lower than the 93.0% of respondents in the previous quarter’s survey who were expecting growth in the next 12 months.

Trade Outlook

Second Quarter 2021 plastics machinery total exports decreased by 6.9% to $367.6 million from First Quarter 2021. Mexico and Canada remained the top export markets of plastics machinery from the U.S. The combined exports to USMCA partners in Second Quarter 2021 totaled $177.2 million, which was 48.2% of total exports of plastics machinery. Imports rose by 3.5% to $874.0 million resulting in a $506.8 million trade deficit. The U.S. plastics machinery trade deficit increased by 12.6% in Second Quarter 2021.

The volume of merchandise trade is expected to increase this year as global economic conditions improve. The World Trade Organization expects to see an 8.4% increase in global merchandise trade this year.

“Until the supply chain issues are resolved, and production lead times return to normal, expect to see fluctuations in quarterly shipments of plastics machinery. Nevertheless, the outlook for plastics machinery in the second half of the year is positive,” said Pineda.

About Plastics Industry Association

The Plastics Industry Association (PLASTICS) is the only organization that supports the entire plastics supply chain, representing nearly one million workers in the $432 billion U.S. industry. Since 1937, PLASTICS has been working to make its members and the industry more globally competitive while advancing recycling and sustainability. To learn more about PLASTICS’ education initiatives, industry-leading insights and events, networking opportunities and policy advocacy and the largest plastics trade show in the Americas, NPE: The Plastics Show, visit plasticsindustry.org

More Stories

The Advantages of Cloud-Based Fax Software for Businesses

40 YEARS OF SILICONE GROWTH IN AMERICA

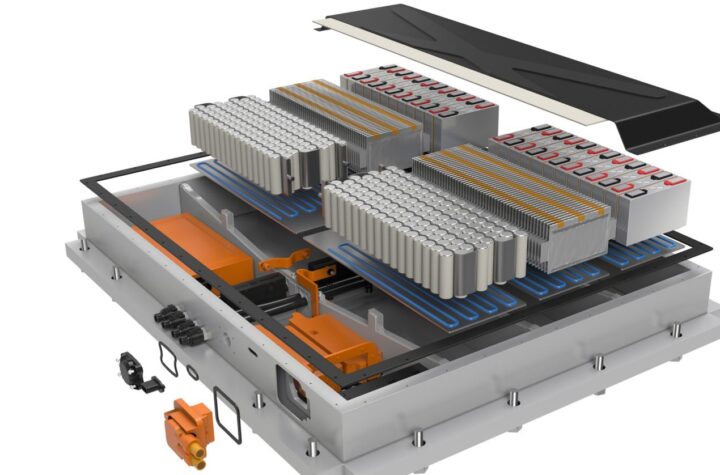

DuPont materials science advances next generation of EV batteries at The Battery Show