The speed and scale of COVID-19 social and economic fallout is quickly materializing in concerns about the future recovery of vehicle demand with the associated consequences on OEMs’ and suppliers’ investment decisions. With cashflow drying up due to sales activity grinding to a halt in core markets and little prospect for an imminent “return to normal”, automakers and suppliers are looking to shore up their finances by preserving cash and other non-critical expenses. This context combined with potential adjustments to the regulatory framework on key automotive aspects in the areas of e-mobility, autonomy and connected car, for example, could potentially have far-reaching implications on the technology deployment as well as short- and medium-term research investment priorities.

The Automotive Supply Chain and Technology Team at IHS Markit has conducted a survey to gather automakers’ and suppliers’ view on:

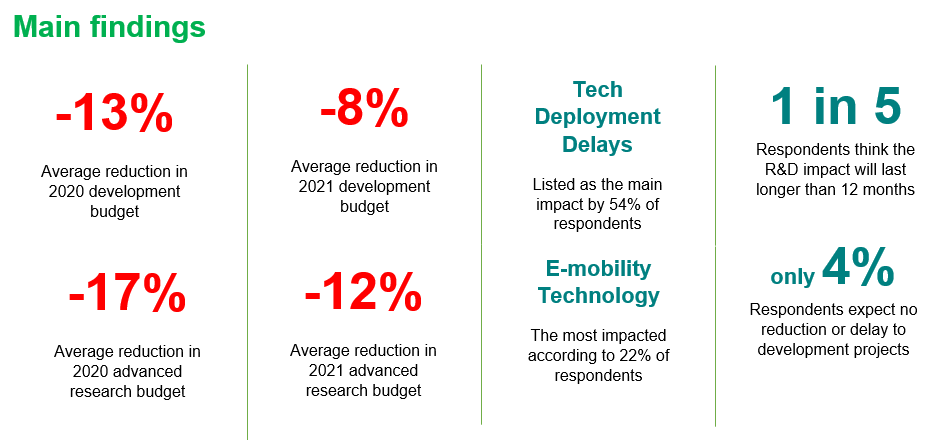

- Size of research and development (R&D) budget cuts

- Outsourcing vs. in-sourcing of R&D activities

- Role of start-ups

- Impact on different domain and technology areas

- Regulatory framework changes

More Stories

Accelerating The Development of Hydrogen Vehicles & Infrastructure – Europe’s Biggest Players Meeting at Premier Event

Automotive IQ Announces the 15th Annual Automotive Functional Safety Week 2025

Major Automotive Companies to Share Latest Developments in Steering, Braking, Chassis and Suspension Systems at Premier Industry Event