In the ongoing and relentless drive to cut costs many automotive companies have been focusing on economies of scale, while ignoring the risk of being too reliant on a single supplier of a component.

This has seen global auto industry come to a near standstill as the Covid-19 virus traveled around the world, disrupting both lives and logistics value chains. OEMs and Tier suppliers which have been cherry picking manufacturing sites for the lowest cost at the best quality and reliability have found that global supply chains are by their nature only as strong as the weakest link.

With hindsight, it is easy to see the warning lights. The 2009 H1N1 flu pandemic reduced GDPs around the world by between 0.5 and 1.5 per cent. Then, Japanese vehicle plants around the world were affected by disruptions to manufacturing following the 2011 earthquake and Tsunami.

Just six months later floods in Thailand closed computer chipmakers, which were the sole supply for automotive companies and computer assemblers around the world. Modern cars don’t work without multiple chips on board.

According to the United Nations Office for Disaster Risk Reduction, the 2011 Thai floods reduced global industrial production by 2.5%. OEMs Toyota, Honda and Nissan reportedly lost production of 240,000, 150,000 and 33,000 cars respectively. Lead author of the study, Masahiko Haraguchi, found that Nissan recovered faster than its competitors. Thanks to its virtual merger with French car manufacturer Renault, Nissan had nearly a decade earlier moved away from the Japanese “Keiretsu” system of tightly linked business alliances. As a result, it was able to execute a more flexible response by switching key parts suppliers. Nissan also had a larger inventory prior to the flooding to make up the demand gap.

Despite these risks, German supply chain consultant Kloepfel Consulting found in a February 2020 survey that every third German company had major Chinese customers and 81% of companies it surveyed relied on Chinese suppliers. These would include companies in the automotive supply ecosystem.

A United States study by the Institute for Supply Management (ISM) found that nearly three-quarters of manufacturers in the country experienced supply chain disruptions in the first months of the Covid-19 outbreak in China. It is estimated that the global automotive industry sources around US$34 billion in components from China a year.

Of more concern is that more than 44% of respondents to the ISM survey said they did not have a plan in place to address supply disruption from China. This was despite the fact that the Trump administration had already been disrupting supply chains by erecting tariff barriers against Chinese imports.

As the textbooks tell us, effective risk management starts with first identifying and understanding the risk. This is where the “Industry 4.0” catch phrase comes in. Managers today can enjoy an unprecedented real-time view of the entire supply chain, from mine to the lifetime of the component in a vehicle. This would include the entire manufacturing value chain, with lower Tier component suppliers and service companies such as haulers feeding in vital information.

All variables should be factored in. Even the weather if it influences shipping schedules. Only once the entire supply chain is visible in real time can any management team have any confidence in their ability to steer the company through this and the next crisis.

There are other benefits that provide a measurable return on the investment in the requisite supply chain intelligence systems. Inefficiencies can be identified and systematically reduced. Informed decisions can be made about the full cost (saving or increase) of shifting from one supplier to another, or spreading the geographic risk.

Moving deeper into Industry 4.0 territory, machine learning risk evaluation tools can identify patterns that indicate risks or opportunities in macroeconomic, geopolitical and global health, exchange rate and other data. With real-time data and the right tools, management can also quickly run different transportation scenarios, such as whether to reroute around a port strike or to make use of an alternative supplier.

To quote Sun Tzu, the Chinese military general and strategist who died in 496 BC, and whose strategies form part of military and business training curricula: “The line between disorder and order lies in logistics…”

More Stories

4 Things to Check Before Buying a Used Motorcycle

Must-Have Car Protection Accessories For Every Season

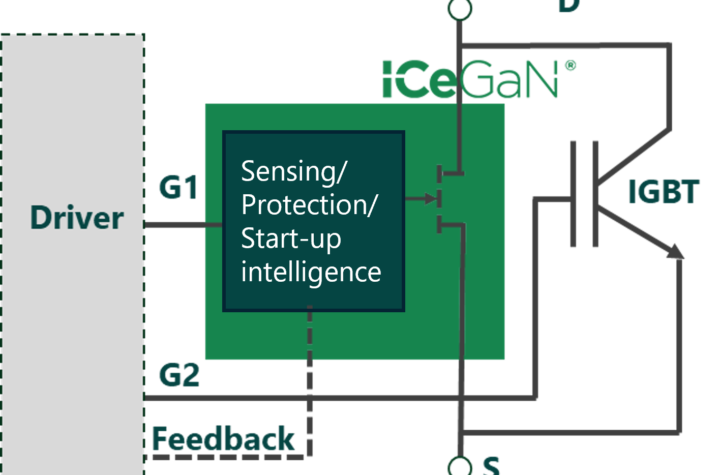

CGD ANNOUNCES BREAKTHROUGH 100kW+ TECHNOLOGY ENABLING GaN TO ADDRESS $10B+ EV INVERTER MARKET