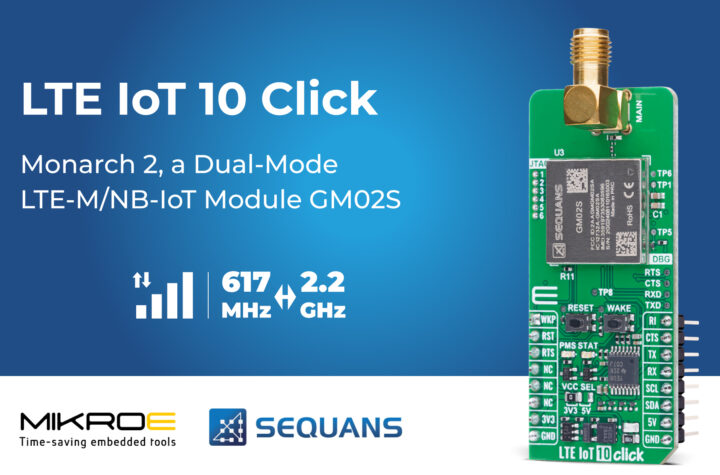

Gone are the days when a wiring harness just carried 12 volts to a relatively small number of points in a vehicle. Automation of a growing number of functions relies on harnesses and controllers transporting and processing megabytes of data.

To find out more about the latest technology Automotive Industries (AI) spoke to Jean-Francois Chouteau, vice president, Global ADAS Centre, Renesas Electronics Corporation. We started by asking what makes the company the market and technology leader in the fiercely competitive ADAS/AD market.

Chouteau: Very few players are seamlessly integrated at our level, mastering end-to-end solutions as we do. This, together with our proven capability to meet stringent automotive quality and reliability standards, makes Renesas one of the strongest suppliers in this segment. Customers choose Renesas firstly because we are the market leaders in both SoCs (systems on chips) and MCUs, (microcontrollers) which are both required in the ADAS segment. SoCs are used to compute and analyze a car’s surroundings based on sensor data, while the MCUs control safety-related functions like steering and braking. Secondly, our hardware and software solutions ensure that customers have the flexibility to scale a solution developed today across entry, mid and high-end features sets into the future. Thirdly, we offer open software platforms, which means our customers can decide whether they want to develop their own software, build a solution with a partner or buy a complete solution. A wide spectrum of ecosystem partners is able to complement our solutions.

AI: What is Renesas autonomy?

Chouteau: Renesas autonomy is an open, innovative and trusted platform for assisted and automated driving. It delivers everything our customers need to build unique solutions at affordable cost and quick time to market. Therefore our promise to them: “You decide what the future of driving will look like”.

AI: What computing power is required?

Chouteau: The required computing power is skyrocketing day by day – especially as the number of sensors keeps increasing, and the obvious need for robustness on the path from ADAS to fully autonomous driving. Standard CPUs (even the most advanced) are no longer able to cope with the required performance increase.

The other challenge is to improve performance without overly increasing power consumption. Renesas overcomes this challenge by combining a variety of different computing engines to achieve the best possible trade-off between computing performance, flexibility and power consumption. Our systems can cope with today’s performance demands, while being scalable enough to handle the power requirements of future developments.

AI: What research and development has gone into Renesas’ semiconductor solutions?

Chouteau: Back in 2014 we set up our Global ADAS Centre with the mission to develop competitive solutions serving the global market. Today, the Center has 100 staff from 15 countries working on the definition, engineering, development and support of dedicated automotive solutions. Our primary focus has been on NCAP (New Car Assessment Program) functions such as traffic signal recognition, lane keeping, and emergency braking, which typically use front cameras and radar as key sensors. Our R&D efforts have therefore been focused on developing highly competitive computer vision and radar signal processing at affordable power consumption and uncompromised functional safety. In the process we are leveraging more than a decade of R&D investments to enable MCUs to meet ASIL-D metrics, We are now reusing this technology on SoCs where existing R-Car H3 and M3 are targeted to achieve metrics for ASIL-B.

AI: What are some of the recent product launches that you think best reflect Renesas’ expertise in advanced automotive computing solutions?

Chouteau: I think the biggest of these is the R-Car V3M. This is the solution for a NCAP front camera technology that manages emergency braking, lane keeping and traffic sign recognition. This product is under development at several of our top customers and will be ready for mass production in 2019. It is available with the open platform business model, so it’s ideal for Tier 1s who want to develop their own camera or vision solution on top of our device solution, as well as for companies who want to work with a partner from our ecosystem to obtain a complete camera solution to help them get to market faster. The R-Car V3M includes dedicated accelerators for low power and high performance – our Versatile Pipeline Engine (IMP) and programmable Computer Vision Engine (CVE). We aim to achieve hardware architectural metrics values recommended for ASIL-B and ASIL-C for the real time core “safety island” with a Cortex R7 lockstep core and dedicated hardware IP. I believe we’re the only company with a working solution available today that is also available as device solution, on platform level or as a complete camera solution, depending on customer needs.

AI: What cognitive computing expertise does your company offer?

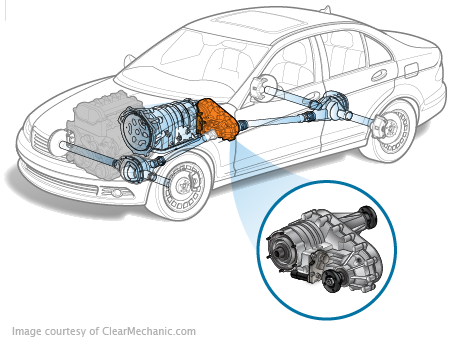

Chouteau: For cognitive computing we differentiate between centralized and decentralized architectures. Centralized is where raw data from sensors is processed and analyzed by one central electronic control unit (ECU) that then does sensor fusion and makes a decision. A decentralized architecture means that the ECU receives “pre-processed” data – i.e data that has already been processed by an intelligent camera system, for example. In that case, the ECU only needs to do sensor fusion and decide what needs to be done, such as braking.

Renesas offers solutions for both of these architectures, depending on customer requirements. Both involve our R-Car V3M system. For a decentralized architecture it would be installed inside the intelligent camera, and for centralized it is part of the central ECU. The solution for centralized architectures is the R-Car H3, while the R-Car M3 might already deliver enough performance for decentralized architectures.

AI: What were some of the reasons for Renesas focusing so heavily on HEVs, EVs and autonomous vehicles?

Chouteau: Analysts agree they will be the biggest growth markets over the next few years. HEV/EV has a projected CAGR (compound annual growth rate) of 18% up to 2020 and for ADAS it’s 17% (source: Automotive Semiconductor Growth Forecast by Strategy Analytics). AI: Where is this technology taking Renesas and your customers?

Chouteau: Leading carmakers and OEMs are working with Renesas to develop their front camera, radar, communication and cognitive functions, and that number is growing. We’ll also continue to develop our open platform, which we feel really differentiates us from the “take-it-or-leave-it black box” approach of some of our competitors.

We’re focusing on areas where we can sell high volumes, with the front camera segment as an example. As the market matures we’ll move into partial automation, conditional automation and full automation, as we’ll be able to build on what we’ve already achieved. We’re already designing and developing solutions for these areas in order to be ready for market maturity and high-volume sales. Another thing we’re doing is expanding our partner ecosystem. With our open platform approach, some OEMs will want to take some elements from us and some from other partners in order to build their own solution, so it’s important that we have a wide choice of competent and certified partners around the world.

More Stories

Selecting the Ideal Linear Phased Array Transducer for Your NDT Requirements

How to Create the Ultimate Off-Road Vehicle Garage: A Practical Guide

K 2025: The Power of Plastics! Green – Smart – Responsible