Automotive industry executives agree that connectivity and digitization will be the number one trend affecting their business through to 2025, according to KPMG’s 17th annual Global Automotive Executive Survey. Self-driving car capabilities are becoming increasingly relevant as industry executives have embraced this futuristic feature as a more important purchasing criterion in years to come. These trends signal that major transformation is ahead as the industry continues to adapt to significant changes and challenges coming its way.

Consumer expectations for their driving experience are rapidly evolving as they demand cars equipped with service-oriented capabilities that enable efficient use of their driving time, and allow them to be online anytime and anywhere. Imaginations have also been captured by the future promise of self-driving vehicles, and the increasing connectivity and digitization of the car is driving a disruption of traditional auto industry business models. Vehicles are increasingly becoming data-generating machines and the auto industry has tremendous opportunities to evolve to more service-oriented business models.

What is top of mind for industry executives during this transformative time? Key survey findings include:

- The future of self-driving cars: Surveyed executives are paying more attention to self-driving vehicles than they have in previous years. With autonomous vehicles promising drivers and passengers the opportunity to use their time efficiently while commuting, 62 per cent of executives surveyed expect self-driving technology to become a more important purchasing criterion to consumers in the next 15 years.

- The connected car: With this transformation already underway, auto industry executives are embracing connectivity and digitization, ranking it as the overarching key trend impacting the auto industry until 2025. This industry transformation is seen to have a significant impact on the production of vehicles as well as the customer relationship – and will enable third party players from the converging information technology sector to intervene in the traditional business model.

- The traditional business model disrupted: As consumers continue to demand increasingly digital products and services within their vehicle, the industry will need to transform their traditional business model. The product development cycles, sales and after-sales processes, as well as the associated products, technologies and services, will all have to change significantly in order to keep up.

- The changing customer relationship: Auto executives are less optimistic that traditional automotive companies will be able to dominate the customer relationship in the connected car. According to one-fifth of all respondents, tech companies (especially from Silicon Valley) could gradually take over the customer interface in the connected car.

“Auto manufacturers are facing complex but exciting times while the car begins to shift to a mobile data-room for drivers. As the vehicle is becoming more and more connected, automakers will need to counter-balance technologies within the car to ensure the drivers’ experience is a safe one while still connecting them to the outside world.”

“Autonomous vehicles will not only allow drivers to use their travel time as efficiently as possible, but it will bring an element of safety to the roads that we have never seen before. Over the next 15 years as we begin to see partially self-driving cars on the roads, we will also likely see a reduced and eventually eliminated risk of accidents on the roads.”

– Peter Hatges, National Automotive Sector Leader, KPMG in Canada

LEARN MORE

2016 Global Automotive Executive Survey

KPMG Website

@KPMG_Canada – #CIAS2016

KPMG on LinkedIn

About KPMG’s Global Automotive Executive Survey

The Global Automotive Executive Survey is KPMG International’s annual assessment of the current state and future prospects of the worldwide automotive industry. In this year’s survey, 800 senior executives from the world’s leading automotive companies were interviewed, including automakers, suppliers, dealers, financial services providers, rental companies, mobility solution providers and for the first time, companies from the information and communication technology (ICT) sector.

About KPMG

KPMG LLP, an Audit, Tax and Advisory firm (kpmg.ca) and a Canadian limited liability partnership established under the laws of Ontario, is the Canadian member firm of KPMG International Cooperative (“KPMG International”). KPMG member firms around the world have 174,000 professionals, in 155 countries.

The independent member firms of the KPMG network are affiliated with KPMG International, a Swiss entity. Each KPMG firm is a legally distinct and separate entity, and describes itself as such.

More Stories

Must-Have Car Protection Accessories For Every Season

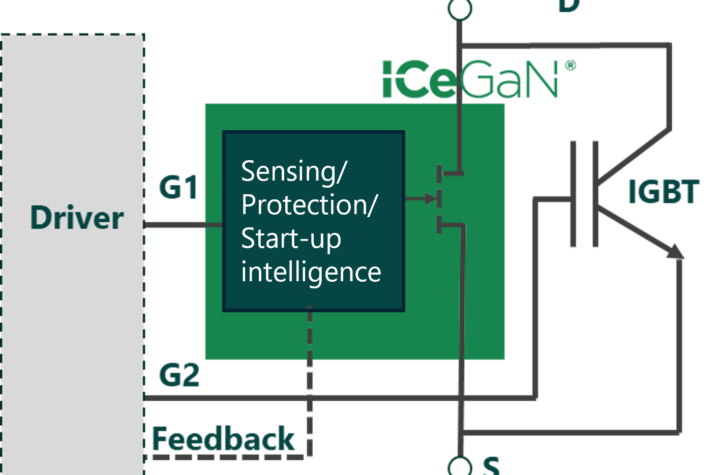

CGD ANNOUNCES BREAKTHROUGH 100kW+ TECHNOLOGY ENABLING GaN TO ADDRESS $10B+ EV INVERTER MARKET

How AI-Powered License Plate Recognition is Transforming Vehicle Tracking & Security