Curbing emissions, reducing consumption and improving reliability are the challenges facing engine manufacturers for both passenger and commercial vehicles, according to Horst Binnig, who has been CEO of KSPG since the start of 2014, Automotive Industries (AI) asked Binnig how the company is positioned in the market.

Binnig: We’re an engine specialist by tradition and most of our products have to do with the engine. To this end, and compared with competition, we have a fairly unique product mix. It consists, on the one hand, of our Kolbenschmidt Hardparts products—the pistons, plain bearings, engine blocks, and cylinder heads. These are products that in the emerging markets of the world are generating favorable growth rates for as now and projected into the future. Then we have the Mechatronics division’s products under the Pierburg trademark. These tend to be Europe-focused, and cover such areas as pollution, consumption and emission reduction. Our third mainstay is Motorservice’s aftermarket business.

AI: Since the start of this year you’ve been KSPG AG’s new CEO. What targets have you set for yourself?

Binnig: KSPG has, according to company rankings and financial analysts, occupied a midfield position among the Top 100 suppliers for a number of years. We successfully left behind us the crisis of 2008/2009, and in fiscal 2013 we delivered an outstanding performance. We will now build on this and pick up pace. We intend to graduate from midfield to a solid position among the top one-third of our peer group. To adopt an illustration from motor racing, I want to be competing up front. In response to the question “Who is KSPG?” it is our systems, capabilities and innovative expertise that must immediately spring to mind as far as our customers are concerned.

AI: How will you go about moving up to the front of the grid?

Binnig: We have a clearly formulated corporate strategy built on our present and future product portfolio. Besides the technology strategy, the most interesting sub strategy is growth within the individual brands. Each of our three divisions has its own trademark and a growth strategy that is largely its own. Even though growth is secondary to profitability, all the divisions are expanding.

AI: What corporate units are included in the three divisions?

Binnig: Behind the Hardparts division we have the brand name Kolbenschmidt. Our Hardparts products are growing at a double-digit rate in those regions of the world where private mobility is generating greater demand. Combined with the localization endeavors of our customers we are able to exploit our global presence with outstanding results. Including China, in the first half of 2013 our Hardparts business grew year-on-year by 15%. With new innovative products, the Mechatronics division, under the brand name Pierburg is still growing chiefly in established markets such as Europe. This, too, is a success story given our repeatedly commendable growth in a European market that been going downhill for a number of years. As for the aftermarket business under the MS Motorservice trademark, we already command a sound position, albeit a little too small. Our target is for this division to account for 20% of KSPG’s total revenue by the end of the decade.

AI: Yet sales growth isn’t everything…

Binnig: Right. We’ve been through that before! In 2013, we generated an EBIT margin of 6.5%. Our target for 2015 is 8%, which I regard as achievable. Our strategic analyses indicate that simply by refocusing our efforts we will be able to increase the potential of all 11 of our business units. We will be allocating priorities clearly. For us this means also generating added value by, for example shelving one or other project to make way for one that is more important. Other aspects of our business that harbor potential are development processes and optimizing the global purchasing chain.

AI: How is KSPG responding to the varying market forecasts?

Binnig: In North America we are selectively expanding our portfolio to include applications in demand in the marketplace. We will strengthen our R&D facilities in Auburn Hills. As to South America, we’re feeling the no-growth effects. Here we are (unfortunately) in good company, but we won’t join in the price wars there! In China, we have meanwhile set up nine plants, and over the past few years have been growing at an impressive double-digit rate. So far this has chiefly taken the shape of joint ventures with HASCO, a subsidiary of the automaker SAIC. But now we will increasingly be present and expanding through our own subsidiaries in China.

AI: This means even more plants?

Binnig: Definitely. We’ll also be again expanding our R&D operations in Shanghai.

AI: And India?

Binnig: For many years now we have held a stake in an Indian manufacturer of engine pistons for cars, trucks and farming machinery. This business is still doing very well. We have a plant of our own that makes plain bearings and pumps. We’re profitable, but sadly due to the weak market our profits are low. Unfortunately, I cannot identify any sustainable growth in India since the automotive market is still suffering mainly because of the underdeveloped infrastructure.

AI: When it comes to KSPG’s future success, what will be the role of commercial vehicle business?

Binnig: There are three very important forces driving commercial vehicle engine developments: reducing fuel consumption, downscaling emissions, and greater reliability. The interplay of these forces offers, as we see it, outstanding opportunities for Kolbenschmidt and Pierburg. After all, there are sound reasons why, since 2009, our commercial vehicle business has been annually expanding by almost 20% and meanwhile its share of total sales at KSPG is some 10%. And this is set to grow even more over the coming years.

AI: At present the global commercial vehicle market is weak because in response to the stricter emissions standards in force since January 2014, fleet owners have been bringing forward many of their purchases …

Binnig: Thanks to our commercial vehicle efforts launched in 2008 we have numerous customer projects in the pipeline, and we’re now having to work these off. We’ve plenty on our plate. And even if over the coming years things settle down regarding emission limits, the call for greener, fuel-saving and hence lowercost technology will not get any quieter. Subjects such as OBD conformity, long-term stable emissions and the new WHDC cycle for commercial vehicles will ensure that engines never stop having to be improved. The various requirements covering CO2 emissions will continue to act as genuine economic stimulus packages, specifically for components suppliers. In the recent past, these requirements have triggered massive innovative momentum that will go on. Europe must continue to lead when it comes to CO2 and emission technologies.

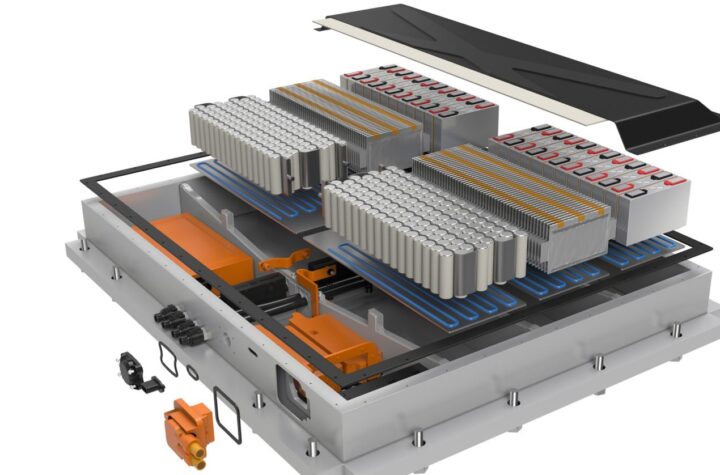

AI: What momentum does KSPG expect from electric mobility?

Binnig: Electric mobility will open up for us a host of options even if the initial euphoria completely dissipates. If the Chinese succeed in installing the infrastructure to provide the energy needed for electric mobility, then this will arrive on a monumental scale, especially in the nation’s megacities. It is something for which the European automotive industry should be prepared. We’re certainly keeping a close eye on local developments.

More Stories

DuPont materials science advances next generation of EV batteries at The Battery Show

How a Truck Driver Can Avoid Mistakes That Lead to Truck Accidents

Car Crash Types Explained: From Rear-End to Head-On Collisions