innovation

Advances in machine-to-machine (M2M) telematics platforms are helping fleet operators to save millions of dollars by minimizing downtime of trucks and trailers, while cargo owners benefit from more efficient delivery systems.

Another beneficiary is the automotive dealer and finance networks, which are able to tap into new markets thanks to the ability to track and trace vehicles in real time. One of the leaders in the development and rollout of this technology is Californiabased Spireon.

Automotive Industries (AI) asked Marc Brungger, who took over as Chief Executive Officer of Spireon in 2013, what benefits M2M solutions offer the transportation and fleet industry.

Brungger: At Spireon we develop telematics, fleet management, asset tracking and MRM solutions customized for multiple-verticals, all built on our four-time award-winning NSpire M2M platform. NSpire’s vertically-specific solutions include our FleetLocate Asset and Trailer Intelligence system specifically designed for the trucking and transportation industry. FleetLocate Enterprise Fleet Management System, designed for large enterprises that operate fleets of 500 or more vehicles; and our Local Fleet Management system, designed for small to mid-sized companies that operate locally concentrated fleets of usually less than 500 vehicles. The benefits of FleetLocate are directly aligned with the overall fleet management processes, from shaping positive driver behavior, to increasing trailer utilization, automating yard checks to managing trailer pools and to enforcing a high level of cargo security. By eliminating the disruptions and delays in critical operations, it also has a profound effect on the satisfaction of drivers. Keeping drivers happy is a critical, bottom-line concern with the shortage of drivers today. And it’s no small point to make that our FleetLocate Trailer Management Platform is the only trailer platform that is powered by all the top tier wireless carriers in the United States. Another advantage our platform provides the fleet industry is its natural extension into the small- and medium-sized service fleet businesses. Their success is built on the same formula as large fleets — be more efficient and you’re automatically more profitable. We offer the same enterprise-grade NSpire platform benefits to these local businesses to manage vehicle usage in real time.

AI: How did the collaboration between Spireon, Sprint and CUSG evolve?

Brungger: It began when the green start flag was waved on one of the speedways in the NASCAR Sprint Cup Series. That led to our partnership with Joe Gibbs Racing, which is affiliated with Sprint through its racing series. Using Spireon’s FleetLocate Joe Gibbs Racing has unprecedented visibility of the team’s haulers as they transport them from race to race. The strategic alliance with Sprint brings together the two leading M2M companies. Sprint played a key role in facilitating this three-way alliance to include CU Solutions Group (CUSG). Sprint has a long-standing relationship with credit unions and especially with CUSG, an organization that represents and serves credit unions nationwide. Spireon also serves a growing number of credit unions that rely on our LoanPlus CMS collateral management solution to help them deliver more value to their members for automotive lending. Credit-challenged members who have been unable to secure credit union car loans in the past are now able to qualify for car loans without incremental risk for the credit union. When it comes to network optimization, Spireon and Sprint have been collaborating for some time to develop CDMA solutions. These solutions will help our customers prepare for the eventual sunset of 2G GSM networks and allow them to take advantage of emerging wireless technologies for faster data speeds, wider coverage, more reliable performance and higher bandwidth. When Spireon and Sprint approached CUSG about connecting their credit union membership to the newest generation of LoanPlus CMS featuring CDMA technology, CUSG was immediately interested. Our LoanPlus CMS solution will now be Sprint’s only collateral management solution for the vehicle finance industry. We’re providing Sprint’s entry-point into the vehicle finance M2M market. It’s a win-win-win-win partnership.

AI: How will this agreement change the way the credit unions and auto companies work together?

Brungger: This agreement gives credit unions and automotive dealers the kind of innovative connected technology that opens up a whole new market to serve — the car buying customer who has historically been turned down for a loan because of credit worthiness. We were already providing our automotive collateral management platform to credit unions. But now, with the alliance we have with Sprint — which is already working with CUSG — we’re arming them with the leading collateral management system in the nation. These tools and features include real-time on-demand vehicle tracking; automated payment reminders; the ability to set up geozones and be alerted when vehicles enter or leave set boundaries; vehicle stop reports that enable STIPS verification; and much more. LoanPlus CMS is a complete collateral management system that delivers a wealth of business intelligence credit unions can use to make better decisions, improve efficiencies, automate time-consuming and error-prone tasks, improve collections, reduce costly repossessions, and most importantly, improve member services, communications and relationships. Our partnership with Sprint also means that CUSG can offer credit unions a secure investment. Because it is CDMA-enabled, LoanPlus CMS will not become obsolete when 2G GSM networks sunset — like so many 2G GSM vehicle tracking systems on the market today will do in the very near future.

AI: To what do you attribute the success of the LoanPlus CMS platform?

Brungger: The success of LoanPlus CMS comes from its flexibility to target virtually all of the needs in the market. It provides the information about the geographical location of the car, which greatly speeds up the process of repossession. But what if you could eliminate the need for expensive repossessions? With our system’s automated payment reminders and a starter disable feature, Spireon automotive customers are able to eliminate the need for repossessions in many cases by improving the member’s payment behavior. This translates into hundreds of thousands of dollars in savings each year for both lenders and consumers. The smart GPS device runs an automated report called an auto report every 12.5 hours and saves it in the device history, which can be pulled up by the lender at will. When it comes to the all-important customer experience, our solution is a full turnkey service, including certified installation done at the lender’s location of choice. At the foundation of Spireon’s success is the hardware itself. We’ve just introduced our 11th generation device, the Talon — with industry leading GPS tracking performance and reliability.

All of these reasons add up to show successful results that hit a lender’s bottom line. Among lenders using Spireon’s Automotive CMS:

• 84% report a reduction in delinquencies

• 78% have been able to finance customers with lower credit

• 68% have been able to finance customers with smaller down payments

• 77% show significant improvement of customer credit ratings

AI: What are some of the other solutions in Spireon’s Automotive Solutions Group that you can tell us about?

Brungger: The future is already here at Spireon. Over the past 18 months, we’ve invested millions of dollars into R&D for our NSpire Platform and deployed over one million NSpire-enabled Talon devices within the automotive finance market alone. Today, our customers are experiencing unfettered access to our applications and tapping into the most extensive network coverage of CDMA — allowing them to track, locate, and communicate with their assets and mobile workforces in more places, more often than any other network available. Now with the rollout of Spireon’s M2M Platform updated with CDMA technology we are looking to redefine the automotive industry standards by delivering unprecedented performance, scalability, security, network coverage and services to dealers through our GoldStar GPS offering. That is why we selected to announce the industries first 99.9% Performance Guarantee. We guarantee that our customers can access their Spireon applications 24 hours a day, 7 days a week, 365 days a year – 99.9% of the time!

More Stories

Must-Have Car Protection Accessories For Every Season

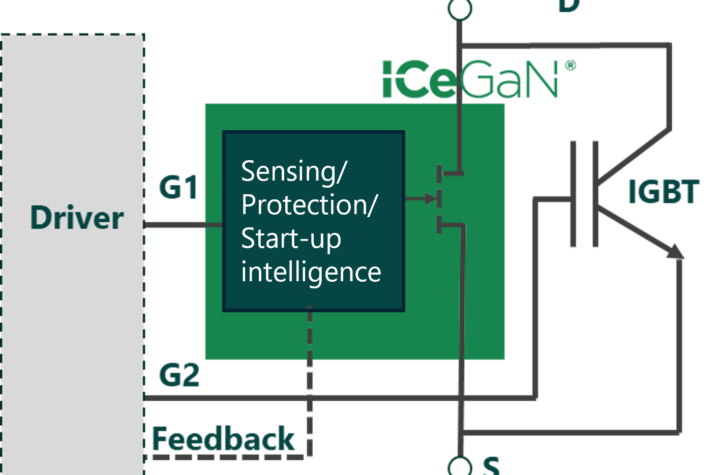

CGD ANNOUNCES BREAKTHROUGH 100kW+ TECHNOLOGY ENABLING GaN TO ADDRESS $10B+ EV INVERTER MARKET

How AI-Powered License Plate Recognition is Transforming Vehicle Tracking & Security