Barriers are to the deployment of connected cars and services are being removed through cross-industry action steered by the Connected Car Forum (CCF). According to the CCF, it is expected that over 50% of global vehicles sold in 2015 will be connected – either by embedded tethered or smart phone integration, and that every new car will be connected in multiple manners by 2025.

Automotive Industries (AI) asked Francesca Forestieri, Director mAutomotive, Connected Living, GSMA, what some of the areas of focus for CCF members will be over the next year.

Forestieri: The Connected Car Forum’s activities focus on areas considered by operators and automakers to be the biggest priorities for enabling increased connected services.

This year we are focusing our activities in five areas:

• Big Data: Creating a sandbox for big data around the connected cars and devices, which fosters mash-ups across different actors and sectors, in order to identify new user experiences, improved internal efficiencies and data monetisation.

• Charging and Billing: Enabling differential charging and billing for in-vehicle services using embedded technologies so as to help foster the deployment of innovative business models for these services.

• Remote installation and management of operator profiles within Embedded SIM cards to facilitate simple and scalable connections for connected cars.

• Mandatory regulatory fitment: focusing on promoting appropriate mobile network solutions for the regulations, while supporting education on industry compliance and the value-add service opportunities fostered by these regulations. European eCall, ERA GLONASS in Russia and SIMRAV in Brazil are current areas of work.

• In-vehicle connection experience: fostering alignment cross-industry on next generation tethering technologies, such as Wifi Direct and NFC.

AI: How will embedded mobile technology influence vehicle design?

Forestieri: Embedded technologies allow for a seamless user experience and enable specific services, such as remote vehicle control features, as well as safety and security applications. In future we expect that the deployment of higher bandwidth services will also be possible through embedded technologies.

The majority of our CCF activities focus on creating the foundation for these future deployments. AI: What’s the latest on progress for implementing 4G/LTE? Forestieri: The deployment of LTE network technology globally is quite pervasive, with close to 200 LTE networks now in operation worldwide. GSMA Intelligence provided the following statistics in their recent report Global cellular market trends and insight — Q2 2013.

• There have been 38 network launches so far in Q2 2013, of which 24 were LTE (including two TD-LTE), three DC-HSPA+ and 11 HSPA+

• There are now 191 live LTE networks worldwide, including 11 TD-LTE, three LTE with VoLTE, one AXGP and Yota’s (Scartel) LTE Advanced network in Russia

• According to Ericsson, global LTE coverage increased from 5% of the world’s population in 2011 to 10% in 2012, and will rise to approximately 60% in 2018

• At the end of Q1 2013 LTE accounted for 1.4% of global connections, while HSPA made up 18% The consolidation of LTE network growth, especially in North America and Developed Asia, is sufficiently advanced. We are seeing more and more automakers rely on LTE for their solutions. Proton, BMW, Audi, GM, Mercedes-Benz, and Toyota having all made announcements regarding LTE services (with deployments starting in 2012 for Proton).

AI: What are some of the legislative breakthroughs CCF has facilitated so far? Forestieri: The CCF has focused on a number of policy issues over the last years, mostly related to mandatory telematics deployment regulations for Europe (eCall), for Russia (emergency call services and value added services: ERA GLONASS) and for Brazil (stolen vehicle location: SIMRAV).

Our work has focused on:

• Providing a platform for alignment across operators regarding their concerns and deployment approaches, as well as input into standardisation

• Fostering appropriate matches between the capabilities of cellular network technology and the national solutions proposed

• Encouraging interoperability across regulatory solutions and coherence with global trends

• Supporting education on regulatory obligations

• Fostering the opportunity for value-add telematics and infotainment services to be built upon mandated solutions All of the regulatory deployments have been complicated affairs with European eCall and Brazilian SIMRAV, requiring more than seven years before deployment. Part of the reasons for these delays has been the necessity to align very different industries upon a common solution. Activities like the CCF can help support these discussions, as the players are working towards a common goal for commercial service deployment.

Our next CCF in London on the afternoon of the 24th of September will focus on both regulatory developments in these geographies, as well as network technology developments updates (both LTE deployments (and the associated frequency bands for different regions) and the evolution of 2G deployments).

AI: What are the challenges in developing markets: ERA-GLONASS (Russia) and Contran 245 mandate (Brazil)…. Will there be similar mandates for China and India?

Forestieri: A number of discussions are underway in other geographies regarding the utility of regulatory mandates following on the trends in Europe, Russia and Brazil. We hope that operators, automakers and regulators will jointly define eventual future regulatory mandates, so that we can avoid the mistakes of the past and ensure that these opportunities are maximised (both in increasing safety & security, as well as to support the knock-on effects possible by embedded technologies for value-add services). Our understanding is that future regulatory deployments are being examined in China, Iceland, Israel, New Zealand, and Qatar. We are not yet engaged with these additional geographies.

More Stories

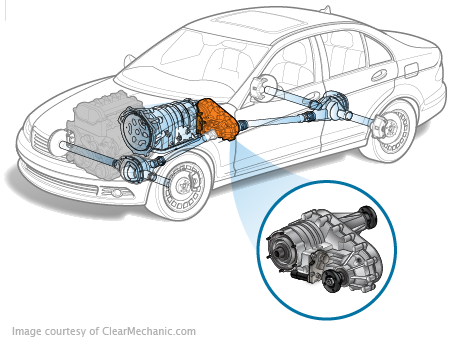

Automating ECU testing for automotive transfer cases using HIL

New LLC Switcher IC From Power Integrations Delivers 1650 W of Continuous Output Power

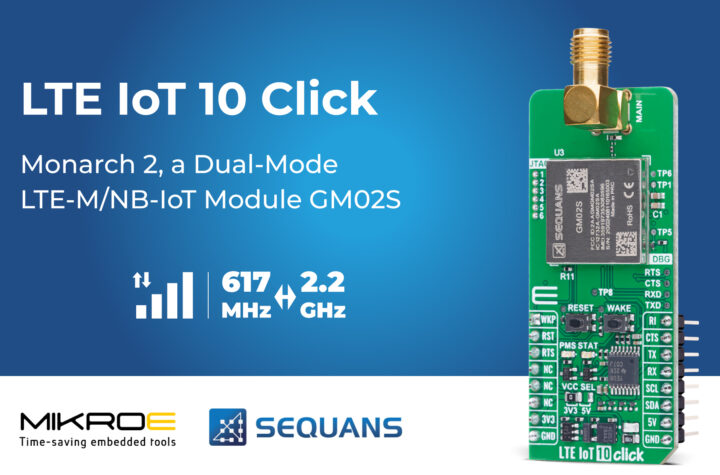

LTE IoT 10 Click Click board from MIKROE provides reliable IoT connectivity