ThorntonGroutFinnigan LLP is a specialty boutique law firm practising exclusively in the areas of insolvency, restructuring and commercial litigation. The Toronto-based law firm was founded in 1998 by Robert Thornton, James Grout and John Finnigan. The firm represents one of the largest car manufacturers in the world.

James Grout has extensive restructuring experience in the automotive, insurance and mining sectors. Mr. Grout regularly represents one of the largest automotive manufacturers in the world in connection with its troubled suppliers.

TGF has been involved in virtually every automotive insolvency case in Ontario in the past ten years including A.G. Simpson, the Versatech Group, Alloy Wheels, Jet Composites, JPE, BBi, Peco, Q3 Aluminum and Tiercon.

TGF’s practice focuses on financial institutions, asset based lenders and investment funds. In addition, TGF regularly represents receivers, monitors and proposal trustees in restructuring proceedings. TGF has excellent relationships with the international and national law firms that consistently refer their clients where conflicts of interest arise.

In April of 2003, Air Canada filed for protection from its creditors. TGF was retained by GE Capital Aviation Services (“GCAS”). GCAS was one of the largest financiers of Air Canada’s fleet. GE provided a DIP Loan of 1 billion dollars to Air Canada which was the largest DIP Loan in Canadian history. Air Canada’s restructuring plan was implemented in the fall of 2004.

In January of 2004, Stelco filed for protection from its creditors. Stelco is the largest Canadian Steel manufacturer. TGF was retained by the Monitor of Stelco. The Monitor is a Court-Appointed Officer responsible for monitoring the affairs of the debtor in possession and facilitating a restructuring of its affairs. Stelco’s restructuring plan was implemented in the fall of 2005.

The Ontario Securities Commission successfully applied for an Order appointing a Receiver and Manager of the Portus Group in March of 2005. The Receiver and Manager retained TGF as its counsel in this receivership. The Portus Group acted as an investment advisor to approximately 26,000 retail investors. The Portus Group invested their funds indirectly in promissory notes with a return linked to the return on a fund of hedge funds. In March of 2006, a bankruptcy Order was made against the primary member of the Portus Group. Approximately $800,000,000.00 was invested by the 26,000 investors through the Portus Group.

The firm’s litigation practice encompasses trial and appellate advocacy at all levels of court and before various administrative tribunals. Mr. Finnigan’s practice includes sitting as an arbitrator of labour disputes. The firm’s litigators represent a wide range of clients in business disputes including financial institutions, provincial governments, publicly traded corporations and officers and directors.

Automotive Industries spoke to James H. Grout, a founding partner of ThorntonGroutFinnigan LLP and asked him whether automotive manufacturers are facing tough times as their margins get squeezed.

AI: What kind of work does your firm do for its automotive clients today and how is this different from a few years ago?

JHG: We have been active in the automotive industry since 1987. Initially, we acted for lenders to suppliers. We dealt with counsel and consultants for Original Equipment Manufacturers (OEMs) and Tier 1 Suppliers on behalf of our lender clients. As a result of those contacts, counsel for General Motors Corporation engaged us as their Canadian counsel to advise them in respect of suppliers to GM experiencing financial difficulties. We have acted for GM and, on occasion, other OEM on troubled supplier cases for the past 10 years. In the past few years, our automotive practice has broadened to encompass acting for Tier 1 Suppliers on a regular basis in dealing with their financially troubled suppliers.

AI: Can you please tell us who your biggest automotive client is and what kind of work you have done for the client in Canada?

JHG: General Motors Corporation is our biggest automotive client. We are lead Canadian counsel to General Motors Corporation and its counsel in respect of financially troubled suppliers to GM. We have advised GM in respect of suppliers who have implemented financial restructurings, sold their business as a going concern or have implemented an orderly wind down of their affairs.

AI: A number of US auto manufacturers have been closing facilities in North America – do you see this trend increasing or do you think the worst is over?

JHG: I expect there will be further plant closures in North America both by the US OEMs and by suppliers throughout the supply chain. The US OEMs were, until recently, unable or unwilling to reduce production because of their collective agreements and their relationships with the United Auto Workers and the Canadian Auto Workers. The US OEMs were producing and selling at a loss, thereby eating into future sales.

AI: From your perspective, how do you think the North American automotive industry will fare over the next few years?

JHG: I am of the view that there are four driving forces in the North American auto industry which will continue into the future. The first is the reduction of production capacity by the US OEMs. Plant closures have been announced in the past year and I expect that there will be further plant closures by the US OEMs. The second is the increase in production capacity by the non-US OEMs in North America. I expect that they will build further production capacity because of their increasing sales in North America. The third driving force is the ongoing consolidation of the supply chain beneath the Tier 1 suppliers. This consolidation is occurring rapidly and is being assisted by the vast amounts of funding available from hedge funds and private equity funds. The fourth driving force is the reallocation of sales by the supply chain from the US OEMs to the non US OEMs reflecting the decrease in sales by the US OEMs and the corresponding increase in sales by the non-US OEMs. The supply chain is in the process of adjusting to the different corporate cultures inherent in the non-US OEMs.

AI: Do you see Asia and Eastern Europe as threats to the North American automotive manufacturing industry? And what does this mean to a firm like yours that specializes in industries like the automotive industry?

JHG: One could perceive low cost Asian and Eastern European OEMs as threats to the US OEMs. However, I think that the cost of shipping will outweigh any cost savings at the manufacturing level. In addition, the Japanese OEMs have understood the need to produce in North America and are increasing if their production capacity in North America on an ongoing basis. I view Asia and Eastern Europe together with the Indian subcontinent as emerging markets for the US OEMs which could turn their fortunes around. As a result, we believe that our firm’s automobile practice will continue to grow as the automotive industry becomes increasingly global.

AI: Do you plan to open branches of TGF in other countries – and if so which countries and why?

JHG: We are a boutique firm specializing solely in insolvency and litigation. As a result we do not plan to open office in other countries. We have excellent long-term relationships with law firms, accounting firms and consulting firms in other countries which has and we believe will continue to have us involved in significant cross border insolvency cases.

More Stories

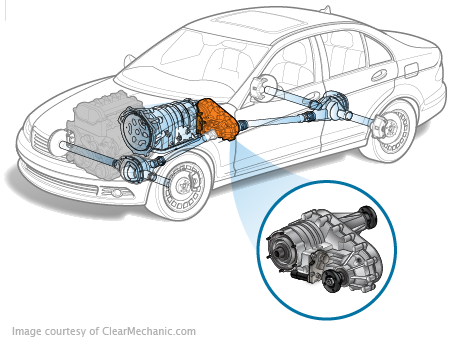

Automating ECU testing for automotive transfer cases using HIL

New LLC Switcher IC From Power Integrations Delivers 1650 W of Continuous Output Power

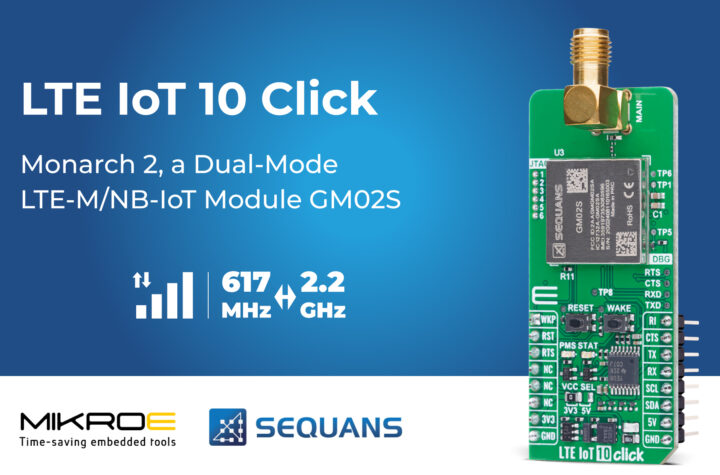

LTE IoT 10 Click Click board from MIKROE provides reliable IoT connectivity