Which suppliers will remain standing once this consolidation that has gripped the world’s automotive industry for the last 20 years has run its course? The strongest will survive, the ones that consistently make profits, the ones that make parts that are so desirable that carmakers pay more for them than they cost to create.

As the battle to lure, win and retain car buyers slogs on, carmakers are clamoring for innovation, quality and low prices in the parts they buy. There are at least two reasons why: Toyota and Honda, which have gained market share in North America at the expense of most other carmakers. Toyota and Honda vehicles provide great value, they are high quality and highly reliable. While Toyota and Honda are ultimately responsible for the vehicles they create, the companies that serve them with parts and systems can also take a great deal of the credit.

Major Toyota and Honda automotive electronics suppliers include Denso and Aisin Seiki (both partly owned by Toyota), Keihin (40 percent owned by Honda) and independent wiring-harness-maker, Yazaki. Like their top customers, they are among the industry’s top performers. They are consistently profitable, and they have been growing faster than the market. Clearly, these companies are good because their main customer is good. Honda and Toyota are probably the two most demanding automotive customers on earth.

After all, you are who you serve.

It ought to follow that suppliers who want to be the best should strive to serve the best, which means suppliers should strive to make Honda and Toyota among their most significant customers. Lots of Western automotive electronics suppliers have tried to do just that, some by setting up shop in Japan. The most successful Western automotive parts supplier in Japan is Bosch, which does business there under its own name and through numerous joint ventures. In 2003, Bosch had over 9,000 employees in Japan and a healthy $1.8 billion in sales to domestic Japanese customers, for both automotive and non-automotive products.

No other automotive electronics transplant has been nearly as successful in Japan as Bosch. Motorola?s Semiconductor Division started operations in Japan in 1968 and by 1991 had managed to win just $30 million worth of sales to automotive customers, 3 percent of the market at the time. Motorola Semiconductor, now Freescale, the world?s number-one supplier of automotive semiconductors, admits its sales in the domestic Japanese auto market today is still ?not a big number.?

Breaking into the Japanese market is daunting, to say the least. Japanese engineers strongly prefer doing business with Japanese suppliers, who easily understand their needs and wants. Japanese engineers would rarely consider buying parts or technology from non- Japanese suppliers if their requirements could be met by their usual Japanese suppliers. When it comes to electronics, the Japanese feel they have no peers.

While the Japanese market is very tough, the market does open up for unique selling propositions. For example, Microsoft?s Windows CE Automotive operating system and middleware form the basis of Toyota?s GBook embedded telematics computing platform available in Japan. Japanese companies have leaned toward the Japanese ?ITRON operating system but Windows is the best at supporting a rich graphical user interface. Windows CE Automotive is also in the Honda Accord navigation system in the U.S.

Another Western company with a best-inclass product is Gentex, the Zeeland, Mich., maker of automatic dimming rearview mirrors. Gentex boasts Toyota among its top three customers. Indeed, the Japanese region accounted for 11 percent of Gentex sales in 2003.

Which companies will be left standing once consolidation plays out? Based on history, we can safely assume that Toyota?s and Honda?s top suppliers will be among the remaining players, as will Bosch. And unless more Western suppliers step up with products that are truly unique and win significant business with Toyota and Honda, most of those suppliers will be Japanese.

Paul Hansen is a strategy consultant in Portsmouth, New Hampshire. He publishes The Hansen Report on Automotive Electronics, a business and technology newsletter. www.hansenreport.com.

More Stories

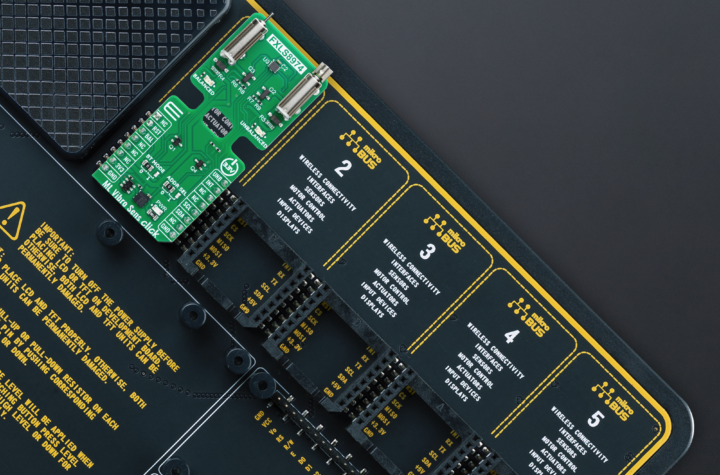

Mosaic Click board from MIKROE delivers global coverage multi-band and multi-constellation tracking ability

Current transducer from Danisense selected for DC charging station testing device demonstrator at TU Graz

New Click board from MIKROE helps develop and train ML models for vibration analysis